In the public session dedicated to the second reading of the Finance Bill, Member of Parliament Abdellah Bouanou expressed his gratitude to the government for responding to retirees’ demands by removing the income tax, despite the delay in implementing this measure.

He emphasized that this was a long-standing request from various individuals and groups, especially given the high inflation in 2022 and 2023. He added that some retirees had been facing an additional tax burden, particularly those who had not benefited from the recent exemptions.

In the same vein, Bouanou highlighted the importance of addressing other categories of retirees who had not benefitted from the new tax measures, stressing that reforms should cover all social groups, including those with low incomes.

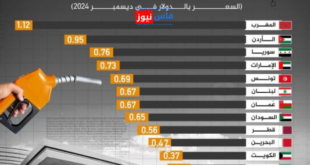

Bouanou also spoke about the need to address other sectors, such as farmers, who face a tax on honey, noting that tax measures should consider the interests of all social groups. He praised the government’s involvement of various stakeholders in proposing solutions, including organizing a study day to address issues related to medicines and challenges facing the healthcare sector.

Regarding tax reform, Boounou underscored the importance of accelerating work on local tax reforms, asserting that development cannot be achieved without the activation of this reform as soon as possible. He also pointed out that the government must continue studying other issues, such as pension system reforms and job creation.

In conclusion, Bouanou called on the government to enhance transparency regarding the distribution of funds allocated to certain projects and ensure that resources are spent efficiently to guarantee fair benefits for all Moroccans. He expressed concern that some groups might be marginalized or that powerful lobbies might continue to hinder real reforms.

source : fesnews media

فاس نيوز ميديا جريدة الكترونية جهوية تعنى بشؤون و أخبار جهة فاس مكناس – متجددة على مدار الساعة

فاس نيوز ميديا جريدة الكترونية جهوية تعنى بشؤون و أخبار جهة فاس مكناس – متجددة على مدار الساعة