The Moroccan Competition Council has released its second report for 2024 on monitoring the implementation of commitments by nine companies operating in the diesel and gasoline market. The report covers the first quarter of the current year, reviewing the development of key indicators and economic data in this sector.

Key points from the report:

- The number of companies licensed to import liquid petroleum products increased to 29 by the end of March 2024.

- Total imports of diesel and gasoline reached 1.47 million tons valued at 12.89 billion dirhams during the first quarter of 2024, an increase of 9.1% in volume and 0.9% in value compared to the same period last year.

- Diesel accounted for about 91% of import volume and value.

- The nine companies covered in the report held about 87% of total market imports.

- These companies’ imports increased by about 5% in volume, from 1.21 million tons in 2023 to 1.27 million tons in 2024.

- The value of these companies’ imports decreased by 3%, from 11.53 billion dirhams to 11.21 billion dirhams.

- Diesel imports increased by 6%, while gasoline imports decreased by 4.6%.

This report is part of the Competition Council’s follow-up on the implementation of commitments made by wholesale diesel and gasoline distribution companies, within the framework of settlement agreements with the Council.

The full file can be downloaded from the official website of the Competition Council from (here).

Analytical Reading:

- General Context:

- This is the second report issued by the Moroccan Competition Council regarding the diesel and gasoline market.

- The report focuses on monitoring the implementation of commitments made by the nine companies operating in this sector.

- The report covers the first quarter of 2024, allowing comparison with the same period of the previous year.

- Import Market Development:

- Notable increase in the number of companies licensed to import liquid petroleum products, indicating increased market competition.

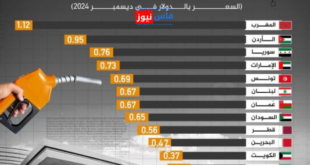

- 9.1% increase in total import volume, versus a slight 0.9% increase in value, possibly indicating a decrease in global fuel prices.

- Clear dominance of diesel in the import market, representing 91% of volume and value.

- Performance of the Nine Companies Covered in the Report:

- These companies maintain a large market share of 87% of total imports.

- 5% increase in their import volume, versus a 3% decrease in value, possibly indicating improved import efficiency or lower global prices.

- Divergent Trends Between Diesel and Gasoline:

- 6% increase in diesel imports, versus a 4.6% decrease in gasoline imports, potentially reflecting changes in local consumption patterns or shifts in government policies.

- Economic Impacts:

- The increase in import volume may indicate growth in local fuel demand, possibly signaling increased economic activity.

- The decrease in import value despite increased volume may have positive effects on Morocco’s trade balance.

- Role of the Competition Council:

- The report demonstrates the Council’s role in monitoring and regulating the market by following up on companies’ commitments.

- Issuing periodic reports enhances sector transparency and helps ensure fair competition.

- Future Outlook:

- Continued close monitoring of the fuel market may lead to further improvements in efficiency and prices for consumers.

- The market may see more changes with new companies entering and evolving strategies of existing companies.

Source: Fez News

فاس نيوز ميديا جريدة الكترونية جهوية تعنى بشؤون و أخبار جهة فاس مكناس – متجددة على مدار الساعة

فاس نيوز ميديا جريدة الكترونية جهوية تعنى بشؤون و أخبار جهة فاس مكناس – متجددة على مدار الساعة